Belgium is currently considering significant changes to its capital gains tax structure, which could have profound implications for business owners looking to sell their enterprises, particularly those with niche companies valued between €1 million and €25 million.

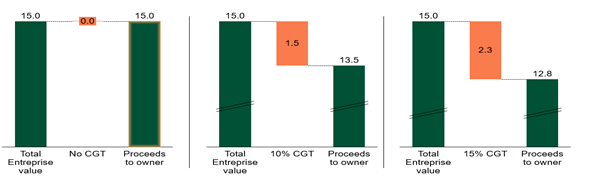

One of the most relevant changes is the tightening of the capital gains tax regime for certain transactions. While the Belgian government traditionally has not levied capital gains taxes on the sale of shares under specific conditions (such as holding shares for at least a year and owning at least 10% of the company), recent discussions indicate that the government is contemplating a shift towards higher taxes on these gains, which could affect the net proceeds of a sale.This could affect the ability to realize capital gains tax-free with any gains potentially taxed at 10% or 15%.

Given the possible impact of these changes, any business owner thinking about a full sale or partial exit should consider accelerating their sale plans to lock in the current tax advantages before any new rules are implemented.

Illustrative examples of the impact of new Capital Gains Tax on a €15m EV business

These changes are still subject to final legislative approval, but they signal a more stringent approach by the Belgian government towards capital gains which could impact the valuation and tax planning strategies for companies of your size. Higher capital gains taxes could mean reduced profits from any sale.

At Upliift we have experience of working with founders of niche software companies across Europe who are looking at a full or partial exit. We have a transparent and fair valuation process led by our European team and can adapt to your timescales, completing a sale in as little as 9 weeks*. Upliift is a European owned and operated company, so if you engage with us, you will gain a significant advantage over selling to a non-European buyer.

Please contact us for more information or an obligation free valuation.

About Upliift

Upliift is Europe’s leading quality-orientated permanent equity investor with a focus on niche European software businesses with €1m – €25m in revenue. Our team of software industry experts across Europe work alongside founders to create better deals for better companies. We collaborate to preserve companies’ brand and culture while making long-term investments that unlock their growth potential and enable founders to fully or partially exit. For more information, visit www.upliift.com.

It may also be prudent to consult with a tax advisor who can provide specific guidance based on your company’s structure and future plans.

* Dependent upon circumstances