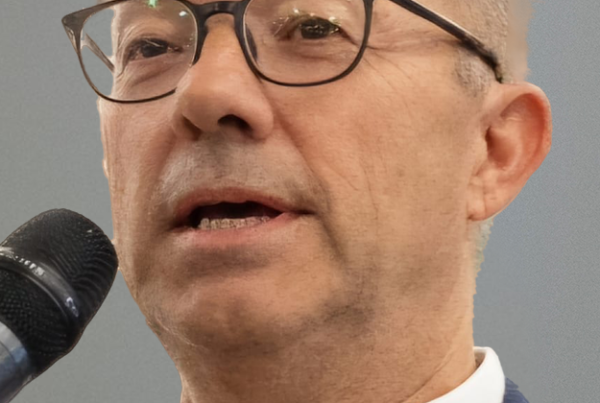

With an unwavering desire to create social impact, Alex Eavis is using her background in big data and analytics as Chief Product & Technology Officer at Genomics. Having co-founded several companies, she is poised to turn her experience into proactive help for founders as an advisor on Upliift’s Healthcare Advisory Board.

Spotlight on

- Health tech founders are typically mission driven. They want to do good or to give something back — otherwise they’d be in FinTech!

- We can’t just keep throwing humans at the demand problem in healthcare. The adoption and correct use of data-driven health tech is the only way we’ll solve it.

- The operating model of healthcare has remained largely unchanged for 80 years or so.

- In order to scale social impact, you need money — profit and social impact are not mutually exclusive.

- The ability for founders to get some value from their life’s work and continue doing what they love doing, supported by Upliift, is a great opportunity.

- If founders can deliver replicable solutions that deliver differences in incremental ways, rather than big bang change, they have a market.

In Conversation

What’s your professional background in the healthcare software market?

One of my ever first jobs was in healthcare, working in the NHS for Wandsworth Primary Care Trust and Southwest London and St George’s Mental Health Trust. It was a super interesting and pioneering project for its time, looking at how to improve the health and wellbeing of prisoners at HMP Wandsworth. Growing from there, I worked for a number of charities tackling the problem of the rehabilitation of addicted prisoners.

What prompted your move into a more corporate world?

It was when someone told me that I couldn’t save the world without money, so why didn’t I go and make money first, then save the world later on. So, I accepted a job in corporate finance. It was different but I loved learning about the minutiae of other people’s businesses. I was working with growth stage companies on their path to profitability, raising public and private money as well as taking companies on to the AIM market.

Can making money and creating social impact co-exist?

Even though I loved my time in corporate finance, it didn’t feed my desire to do social good. At the same time, I could see that in order to scale social impact, you need money—profit and social impact are not mutually exclusive. So, I found a way to bring them together in three different start-up ventures.

Can you tell us about the companies you set up?

The first of the three companies I co-founded was in the social care space. We were selling into local government, repurposing IoT hardware with novel software to monitor people living independently, or those in assisted living helping them to live more independently rather than in institutions. My other two companies were also in the health and social care space. I’d say one of my ventures wasn’t successful, one did OK, and the other did quite well. So, I’ve very much been at the coalface in terms of working out how to start and scale a health tech company.

How did you become involved in some pretty major acquisitions?

The last company I founded was acquired in 2018 by electronic health record (EHR) company EMIS, a provider of clinical systems to various care settings. It was most famous for its primary care footprint, which saw it supplying about 60% of GPs in the UK, as well as community pharmacies, hospital A&E departments and mental health settings. I built up their data and analytics business and ran the product team.

I then helped with the acquisition of EMIS by one of the largest healthcare companies in the world, United Health Group (functioning as Optum in the UK). While this made EMIS one of the very few UK health tech unicorns, the $1.5 billion it was bought for was probably a drop in the ocean for United Health Group when you consider its turnover of over $500 billion a year!

So, you were back in big corporation territory — how did you like that?

I left shortly after the acquisition. I knew I didn’t want to work for a massive corporation. I’ve now joined Genomics plc as their Chief Product & Technology Officer. They’re a science-led company with an advanced genomic intelligence data & analytics platform and are doing some interesting stuff in the drug discovery and preventative healthcare spaces.

As a founder, how did you feel about being acquired by a much bigger company?

When my company was bought by EMIS (in turn subsequently acquired) they tried to align us with how they did things. But this ‘big company’ approach stifled innovation. It’s an acquisition model that typically sees the acquired company either being viewed as a bolt-on revenue opportunity or as a way to get hold of an interesting piece of tech without having to build it yourself. Both the technology and the people are simply ingested by the bigger business. That’s not what a lot of founders want for the companies they’ve built and owned often for decades.

How does Upliift turn your previous acquisition experience on its head?

Upliift offers a very different model to founders. It’s one that enables the founders to extract some value from all their hard work — perhaps to pay off their mortgages! Let’s be honest here, nobody enters health tech because it’s the most profitable thing to do. Rather health tech founders are typically mission driven. They want to do good and give something back, otherwise they’d work in FinTech! So, the ability for founders to get some value from their life’s work and continue doing what they love doing, supported by Upliift, is a great opportunity.

How did you learn about Upliift?

I’m a member of Boardwave, the network for European software CEOs, founders, chairs, independent NEDs and investors. Its goal is to make European companies as successful as US ones and Upliift has partnered with Boardwave to help make this happen.

Why are Boardwave and Upliift needed by European software founders?

So many European software companies sell out when they reach a certain size. Why is that? It’s hard to take a company from innovation to implementation and adoption. The change management piece as you go through this cycle is massively underestimated. And health tech companies in particular can struggle with this. Of course, it’s great once your tech has been adopted — med/health tech tends to be ‘sticky’ so has longevity. The long timeline to get there is the challenge, however. With Boardwave and Upliift taking a long-horizon view (as opposed to VC money pressurising founders to make a quick buck) founders have a more measured capital model that enables them to stay with and grow their companies.

Are health tech companies more at risk than other software companies as they attempt to scale?

I can’t answer this with absolute certainty, but I’d say yes. Health tech is a crowded consumer space and, certainly in the UK, we’re used to a publicly funded system so I see consumers asking why they should have to pay for health apps. On the B2B side, the buying cycles are really long, healthcare funding is erratic, and change is hard. That’s especially so in hospitals that are functioning 24/7 as critical businesses, so they can’t shut down for any length of time to change systems. So, yes, it’s a harder sector than most, so I expect the failure rate is a lot higher.

What type of health tech is most likely to gain traction in this tough landscape?

While we read about the headline-grabbing, exciting new applications of health technology, there’s a massive gap between what is possible and the actual reality of tech that is affordable and meets the need to provide equitable care for everyone. So, it’s the more mundane technology rather than the exceptional, super high-tech products that are the bedrock of health tech. Also, many of the headline grabbing tech solutions have been tested in a lab setting but getting them from research to clinical grade is a big lift, requiring a large investment while also trying to embed them into care settings and pathways that haven’t changed for decades.

What do you see as the most significant trends shaping the healthcare software market across Europe today?

All countries are grappling with the same challenges of an ageing population, more long-term conditions and demand that’s outstripping supply. The operating model of healthcare has remained largely unchanged for 80 years or so. What you often see is technology chipping away creating small efficiencies around the sides, but it can only make so much difference because of this unchanged model. We can’t just keep throwing humans at the demand problem in healthcare. The adoption and correct use of data-driven health tech is the only way we’ll solve it.

So, I think we’ll see a shift in focus towards productivity, such as process automation and workforce productivity, before any major adoption of the sexier clinical digital support and diagnostics solutions. We will see AI change things, but more in this less glamorous productivity space first — and we’ll see a different approach to the adoption of AI and use of data between the US and the more strictly regulated European market. The ‘more with less’ mindset that’s needed creates opportunities for the more niche, less glamorous companies, many of which are the type and size that Upliift invests in.

Can you elaborate on these opportunities for the smaller, niche companies?

If they can deliver replicable solutions that deliver differences in incremental ways, rather than big bang change, they have a market. The founders of these companies are often heads down trying to do what they’re doing, so it can be difficult for them to grow either through product development or through innovation that allows them to diversify and expand across geographical boundaries. So, Upliift’s model is an opportunity for them to lift their heads up, see the bigger picture and grow their businesses.

What do you see your role as an Upliift advisory board member?

Initially we’re looking at the different themes and opportunities in the healthcare sector, whether that’s in geographies, care settings or technologies. As we continue to make acquisitions there will be closer alignment between the companies we’re investing in.

Having been through the startup and M&A process myself, I bring a hands-on perspective. I’m looking forward to helping founders grow their businesses, whether through acquisitions, developing new product lines, or mergers. The beauty of Upliift’s model is that it’s not just about identifying opportunities; it’s about helping businesses grow through collaboration and support. We can offer founders a chance to scale their impact without the pressures of short-term VC investments. It’s about building something sustainable.