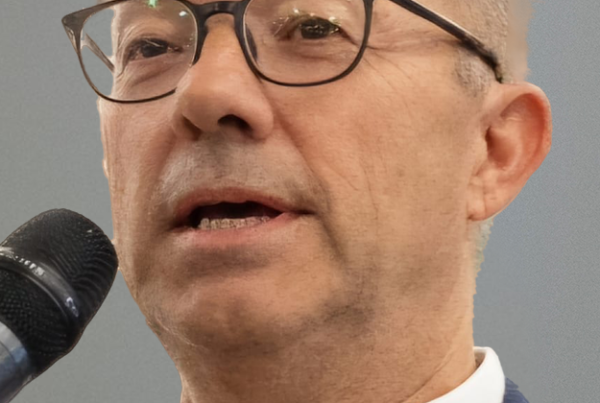

Fred Hessabi has more than 40 years’ sales and leadership experience in the software industry. He reflects on his role over the past four decades and explains his new role as an Upliift advisor, expanding on how Upliift’s permanent equity model and hands-on approach helps drive value for founders of Europe’s niche software companies.

Spotlight on

- I’ve been through multiple versions of the same industry and each time the size of the market has grown exponentially.

- When looking for an investor it’s about more than just capital and how to strike a deal. It’s about a shared long-term vision.

- Upliift helps position companies in the market, working on their product and pricing strategies, building a strong go-to-market and looking at M&A growth opportunities.

- Upliift helps smaller software companies avoid the pitfalls on this journey, ensuring they do things right from the outset.

- I can add value by bringing the value of my experience to the companies that Upliift invests in.

In conversation

What’s your background in the technology industry?

I’m a fully paid-up software guy! I’ve worked solely in the software industry for the past four decades. Forty years ago, I worked with the world’s number one software company with a total annual revenue of $65 million. At the time, SAP was number seven in the ranking with a revenue of $15 million. It was a $200 million application software global market, which today represents the value of just one deal! The whole software business was on mainframe machines, which most people (except a few banks) have forgotten about today.

What aspects of the industry have you experienced?

Moving on from the mainframes, it was all about downsizing (or rightsizing), adopting peer-to-peer mid-range systems, such as HP or VAX. Then I moved into microcomputers, followed by cloud. And now it’s all about artificial intelligence – AI. So, I’ve been through multiple versions of the same industry and each time the size of the market has grown exponentially. I worked in indirect and direct sales, in start-ups like Siebel or EndecA and with major P&Ls, such as that at SAP where I ran a big chunk of mature SAP countries, like the UK, France and the Nordics. In a sense, having seen almost every go-to-market model, I’ve grown up in the evolving software ecosystem.

How did you find out about Upliift?

During my career I have helped a number of US-based companies grow and expand into Europe. Over time, I made a lot of those people rich and had reached a point where I wanted to give something back to the European software industry. I began that process at Boardwave, the networking community for founders, CEOs, chairs, etc., where I am a patron. By association, I came across Upliift and was impressed with its focus on investing in smaller niche companies who form the bedrock of the European software industry.

What made you decide to become an Upliift advisory board member?

Boardwave founder and CEO Phill Robinson introduced me to Upliift co-founder and co-CEO Alex Myers, who told me all about Upliift’s mission. For the four years prior to that I’d been CRO at billion-dollar European software company HERE Technologies, running its worldwide sales. Upliift’s proposition was very different, with its focus on long-term investment in European smaller yet high quality, well-established businesses that service niche markets, and I was quickly on board with it.

Why is Upliift’s permanent equity model important for this market?

If you look around Europe there is no shortage of software companies, software developers and people coding. However, they’re all in their own corners and locked-in to their own mini markets. By working with founders looking to move onto something else Upliift can bring these companies on. Drawing on extensive personal experience, the Upliift team helps to position companies in the market, working on their product and pricing strategies, building a strong go-to-market team and looking at growth opportunities. Upliift invests for the long term with no time limit. This sort of long-term focus and support isn’t readily available to founders with venture capital and private equity investors. That is a real value add and a major differentiator for Upliift.

What do you see as your role in this?

I am fortunate to have had a remarkable career with extensive experience in the enterprise software industry. I’m now focusing on advising companies, leveraging my knowledge to help guide businesses, particularly with their go-to-market strategies.

In terms of how I support Upliift itself, I see part of my role as helping founders to recognize the Upliift difference. These founders have access to many funds, with numerous options available to them but it is Upliift’s additional support and permanent investment model that can make all the difference. It is about more than just capital and how to strike a deal. It’s about a long-term vision; it’s about finding alliances and partners to take the business forward; it’s about tapping into Upliift’s experience and its mission to support founders of smaller, niche vertically focused businesses who are the bedrock of Europe’s software industry. I have built a broad network of CEOs and founders in Europe and want to help them realise this value.