Jonas Lang is a member of the Executive Board at 2HMforum and is their Head of Sales for FANOMICS. He talks about the value of turning satisfied customers into true fans and how Upliift is using the FANOMICS programme to help guide founders and steer investment decisions.

Spotlight on

-

- Good customer relations and a high fan quota help companies grow.

- Customer satisfaction doesn’t always equate to loyalty.

- If you invest in a company with bad customer relations, there’s a risk to revenue of key customers leaving. Conversely, a high fan quota can drive more revenue.

- Customers who behave like fans are less price sensitive, inclined to recommend and more willing to cross-buy than others.

- By looking at all the touchpoints along the customer journey, the FANOMICS assessment yields high transparency between Upliift as an investor and company founders.

What’s your background with FANOMICS?

I joined 2HMforum in 2007 and am on the Executive Board. 2HMforum is theinternational market research and consulting company that developed FANOMICS. I am responsible for managing the FANOMICS clients as we help them to turn customers into valuable fans and profit from this.

What is FANOMICS?

FANOMICS is a management program for increased success, focused on customer value and profitability. It gives company founders and owners a methodology for turning satisfied customers into loyal fans. Companies often believe that success is all about satisfying their customers to the max. But that’s misleading because satisfaction doesn’t always equate to loyalty. That’s the rationale behind FANOMICS. And when you increase your fan rate, you increase your profit! This is something that we can help with across sectors, although FANOMICS has a high expertise in the European software industry.

How does FANOMICS work?

FANOMICS transfers the scientific, evidence-based findings of the Fan Principle to the relationship between businesses and their customers (and employees). The subsequent fan relationships provide purpose and lasting success. In seeking to turn customers into fans, we developed an indicator whereby we asked how we could find relationships that went beyond a product or its price. That’s because a satisfied customer might simply be one who’s got a great price and has no emotional loyalty to the product, whereas scientific research shows us that a fan goes beyond purely satisfaction.

You mention science – can you expand on that?

You could say that the science of fans began with the Beetles and ‘Beetlemania’. There is a key message from the Fan-research: Fan-relations are based on identification. Which means that Fans experience a match between their central needs and the traits of ‘their’ stars. So identification is the precondition, but that is not enough. Identification has to repeatedly made tangible, because this creates a perceived uniqueness.

How does this equate to a company’s customers?

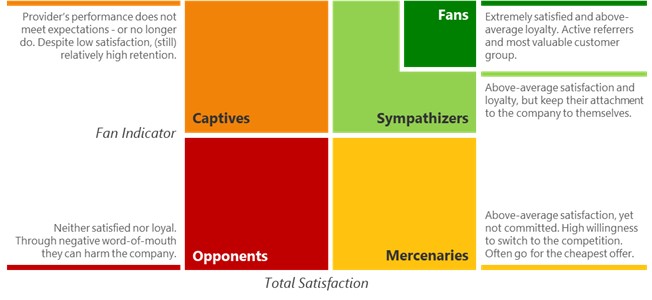

The combination of these two aspects (identification and uniqueness) leads to customers who behave like fans. They’re less price sensitive, are inclined to recommend and are more willing to cross-buy than others. In other words, they become fans. With FANOMICS, we translated this research-led understanding into the relationships between software vendors and their customers. How well does the company fit with the needs of the customer. Is the company unique in the customer’s eyes and the most attractive provider in this field? When you combine this with satisfaction you get specific types of customers.

What types of customers does FANOMICS identify?

First, of course, it identifies FANS– customers who have maximum satisfaction on the one hand and strong loyalty on the other. These customers have a high value to the company, with a higher contribution margin and strong willingness to cross-buy, etc.

Then there are those customers who are simply ‘satisfied’ rather than loyal fans. We call these customers MERCENARIES. They do not recommend and might be price sensitive. Importantly, both FANS and MERCENARIES are satisfied customers, but their value to the business is very different.

Those customers who are not satisfied fall into two groups. We refer to the first as CAPTIVES. They are emotionally captured by a product but currently not satisfied, perhaps because something has happened to affect their satisfaction, such as a quality issue or poor customer service. The good thing about CAPTIVES is that there is an opportunity to win back their loyalty and turn them into FANS. Then there are customers who are neither satisfied nor loyal. We call them OPPONENTS and they are most likely to share their anger or disappointment about a product or service with others and this can lead to collateral damage.

You are now working with Upliift – how did that come about?

I first got to know Upliift through Michael Hammerström, one of the Co-founders, who I’ve known for around 10 years. After Upliift was established, we regularly talked about the importance for a business investing in other companies to have an understanding of the relationship quality between the company and its customers, alongside the economic KPIs that you’d expect. Good customer relations and a high fan quota help companies grow, which is important for both investor and the company being invested in. If you invest in a company with bad customer relations, there’s a risk to revenue of key customers leaving. Conversely, a high fan quota can drive more revenue.

How is Upliift utilising FANOMICS?

Upliift’s permanent equity approach gives them a genuine interest in the companies they invest in. They want to work with companies that last and have sustainable relations with their customers and their employees. So, as part of their due diligence when exploring a potential investment, they buy a FANOMICS service that checks the fan quota and satisfaction level.

This initial check is funded by Upliift, giving them and the founders of companies they want to invest in a good insight into the customer relationships and what can be done to optimise sub-optimal ones.

What happens after the initial FANOMICS assessment?

While Upliift funds the first check as part of their due diligence, we also offer founders and company owners the opportunity to dig much deeper into this topic. This is a standalone service and can take the fan analysis in different directions, such as to include employees. In this respect, we use our methodology to track the satisfaction and loyalty of staff. This is an especially useful exercise when a new investor has come on board, which might unsettle some employees.

Beyond the internal analysis, we, of course, work with companies wanting to turn their external customers into fans. We focus on the two aspects of identification (how do they fit with their customers) and perceived uniqueness, analysing the core needs of their customers. We might also look to identify aspects with no influence on loyalty that the company doesn’t need to focus on at this stage. This can help drive efficiency, while keeping the focus on building the fan quota.

We also help teams working on different customer touchpoints to focus on their customers’ core needs. We work with them to identify what they need to do or change to drive value to their customers and, as such, to the business.

What is the benefit of Upliift introducting FANOMICS to its companies?

We have touched on this above but, in essence, it’s an assurance of gaining a trusted and independent perspective on their fan quota and its revenue boosting potential. By looking at all the touchpoints along the customer journey, the initial FANOMICS assessment funded by Upliift, which includes a customer survey, yields high transparency between Upliift and founders. From there, we continue to work with the companies to ensure that their growth strategies, brand evolution and product development have fans at their core.